Growing buyer confidence and a rising number of sales in the first half of 2024 are translating into a firming up of home values.

Our latest estimates reveal the average UK home is now worth £278,000, up £2,400 from December 2023.

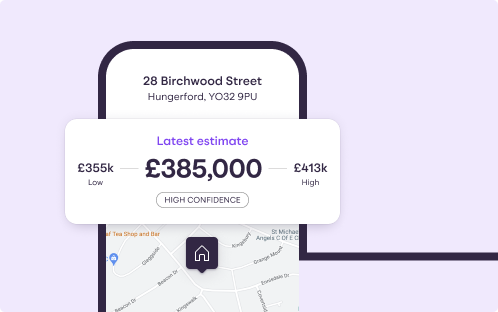

Every month, we generate value estimates for nearly 30m UK homes, using a combination of local sold and asking price data to show indicative home values.

Our data reveals half of UK homes (15 million) increased in value in the first half of 2024 by 1% or more. That’s the highest number since December 2022.

My Home: track your home's value

Discover how much your home could be worth, track its changing value over time and find out what homes in your area have sold for.

And while most of the gains are modest, a third of UK homes (10 million) went up by £5,000 in value, that’s twice the number of homes that saw this increase in 2023 (5.4 million).

In the same period, 8 million homes (27%) have kept their values broadly the same (changes within 1%).

Overall, 6.7 million UK homes have fallen in value by at least 1% since the end of 2023, a sign that some markets are taking longer to recover from the effects of higher mortgage rates.

That said, 14 million homes were losing value at the end of 2023, so it’s a step in the right direction for homeowners impacted by recent price falls.

Meanwhile, the north-south value divide continues, with fewer homes in the south gaining value, as higher prices exaggerate the impact of higher mortgage rates on buying power.

Terraced homes in the north make biggest value gains

Home values are rising fastest in northern England.

In Yorkshire and the Humber homes went up 1.4%, while in the North East they rose by 1.9%.

Overall, half of homes in northern England went up in value by £1,000 to £10,000, while 1 million homes (14%) gained more than £10,000.

Homeowners in Oldham (83%), Wakefield (77%) and Co. Durham were most likely to see their home values increase by 1% or more.

And homes under £150,000 are seeing the greatest value growth (5%+), especially terraced properties, with nearly a fifth rising by 5% or more in value.

This clearly shows that value-for-money homes are a popular choice among buyers facing higher mortgage costs.

Most expensive homes more likely to go up in value in southern regions

Pricier homes in the south have seen their values impacted by higher mortgage rates and consequently their home values are taking longer to recover.

Since the start of 2024, the typical value increase here has been below 1%. Yet nearly 6 million homes have risen by more than that - the highest number since the end of 2022.

The top 10% of the most expensive homes in the south actually saw more gains than their cheaper or average-priced counterparts.

In areas where house prices are above the average, such as West-Central London, Watford and Bath, 7 in 10 homes have risen in value, with most seeing gains of £5,000+.

However, nearly 3.5 million properties in southern England have continued to see their values fall - and many of these homes were detached.

The market for these homes suffered from a demand/supply imbalance earlier this year, as aspirational buyers continued to reassess their requirements in the face of high borrowing costs.

Will home values keep rising now?

Our expectation is for house prices to grow by 1.5% by the end of the year.

But the south-north divide is here to stay, with homes in the north showing above average growth.

Those increases are unlikely to return to pandemic levels however, unless mortgage rates fall dramatically.

Meanwhile, house prices in the south of England are expected to continue to track below the UK average as they realign with people’s incomes.